How to Find a Short Term Rental in Austin

Buying a house to use as an STR in ATX can be an amazing investment. Renting a place out for a few days at a time instead of a long term can have amazing returns, even with all the additional costs. Let’s figure out how to find a short term rental in Austin, and how to make the numbers work.

Austin is a great destination city, lots of people come to visit and need a place to stay.

We are the Live Music Capital of the world. There are world-class yearly festivals like SXSW, ACL, and F1. There is the new professional soccer team and Q2 stadium Every week there are numerous conferences happening all over town. I was surprised to learn that Austin is a major wedding destination.

All these people visiting need a place to sleep. Some like hotels. Others want a more personal experience. They are interested in renting a room or a house either for privacy, or to have a more in-depth time in the city.

Austin Short-Term Rental Rules

To start with, the city of Austin has an ordinance for properties that are used for AirBnB. I’ve made a post about Austin STR rules, that you should read first. There are 3 types, and permits and fees are required for each.

Type-1 is a house that you live in. You either rent it out when you are out of town or rent out room(s) while you are present

The second, Type-2 is a pure investment house – where you don’t live in it at all. Note that Austin is not handing out any permits for Type-2 as of Spring 2022.

Type-3 are multifamily units used for short-term rentals.

So, if you are looking for a pure investment house (Type-2) it can be difficult to get one in Austin. However, I have some strategies that can help. One is to look in cities near Austin with relaxed short-term rental rules.

How Profitable are Short Term Rentals?

When I evaluate a property for profitability, as an investor, I look at two basic parts – month over month cash flow and long-term equity.

I’ll be honest, buying a house in Austin is expensive. Our median price has doubled in the last few years due to lots of people wanting to live here. But I also expect it to continue to rise well into 2030.

So, for at least the next 5-10 years, I believe we will see equity increases as people buy and hold on to houses for a longer time frame.

When it comes to monthly cash flow 8-12%, is an excellent return rate – however, this is based on a lot of factors:

- Monthly mortgage

- Operating Expenses and Turnover costs

- Cleaning

- Supplies

- Maintenance

- Furniture and decor

- Advertising Fees

- Management Fees

It can be difficult to obtain specific rental rates for Short Term Rentals – Realtors don’t have this information. Instead, there are two companies I have used – AirDNA and Mashvisor. With these sites, you can search for data and get the info you need to make informed decisions.

How to Find a Short Term Investment Rental in Austin

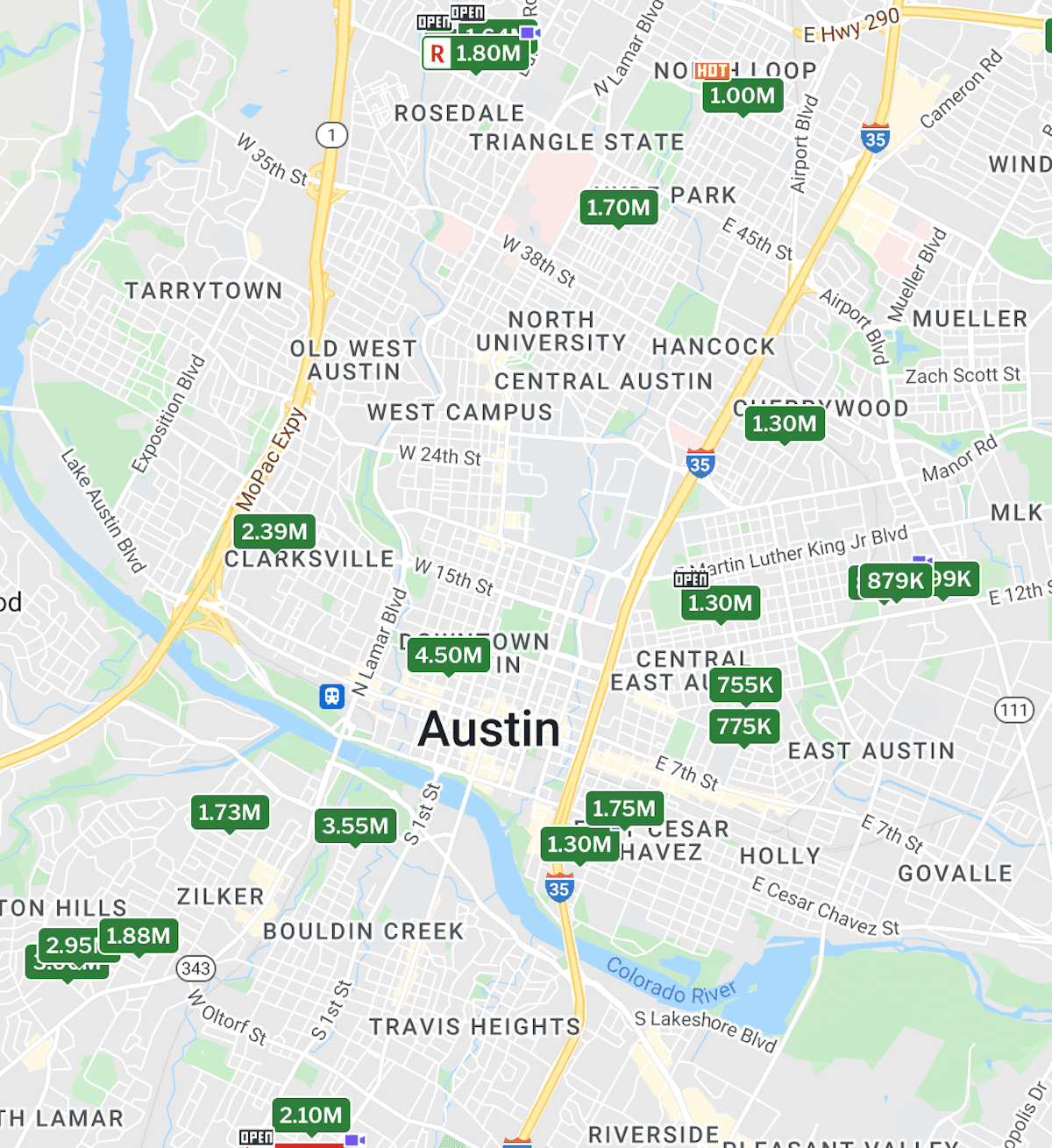

There are lots of different search portals for Real Estate. I like to use Redfin because of the interface and the amount of additional data they provide.

Specifically, I have set up a search that sends me emails every day with new candidate properties. I call it ATX STR, and whenever I get it, I take a quick look at the property pictures and profile to see if I want to investigate it further and run some numbers.

My basic search parameters are

- Location – I have just drawn a big circle around Austin – From Georgetown in the north to Manor in the East, Manchaca in the South, and Lakeway in the west.

- Price. Since this is an investment house 20% down will be required, but more might be necessary to make the numbers work. I calculate how much cash I have and back-calculate the percentage of the total property.

- It has to be a stand-alone house.

- Bedrooms = 2-3 (a small family or 2 couples should be able to stay there comfortably)

- Square feet – Under 1750 so it feels cozy but not too cramped.

- NO HOA. I don’t want that hassle.

The first thing I look at is the location. I open the map view and see where the house is located. Is it too close to a major road? Is there something weird nearby that could lead to a negative review? How close is it to “cool Austin stuff”?

Remember, the 3 rules of Real Estate – Location, LOCATION, LOCATION!

Next, I look at the pictures of the house

Is it updated? Is it cool? Would I want to stay there? How much work does it need to become a good Homeaway Property? Do the photos look OK? Can I see an easy way to furnish it? How is the curb appeal? What about the parking situation? Is the backyard alright?

If a house passes the location, and photo check, then I read through the description.

Are there any red flags in the description? Things like foundation damage, AS-IS sale, and other deal-breakers. I’m not necessarily looking for a deal, but instead a great rock-solid house that I can hold on to for 10 years.

If it goes through these 3 things ok – (location, photos, description), then I start to look at the numbers – what is the expected daily rate I can expect? How often will it be rented out? What are my costs going to be to get it up and running? How much will it cost to maintain?

If your budget is good, it is easy to find properties. I recommend having a 30-35% down payment and another 5-10% in reserves “just in case”.

One thing to keep in mind is that it is impossible to get a Type-2 permit in Austin currently. So often I’m not looking in Austin, but nearby cities. I’ve made a list of other nearby towns and listed their requirements.

The prices for homes in some of these areas are just a fraction of what Austin prices are, and using the above websites will show you that these areas can be just as profitable even if they aren’t right downtown.

Final thoughts

Finding the right STR property can take some time. There are so many things to consider. If you need help learning How to Find a Short Term Rental in Austin, let me know. I’ll see what I can do.